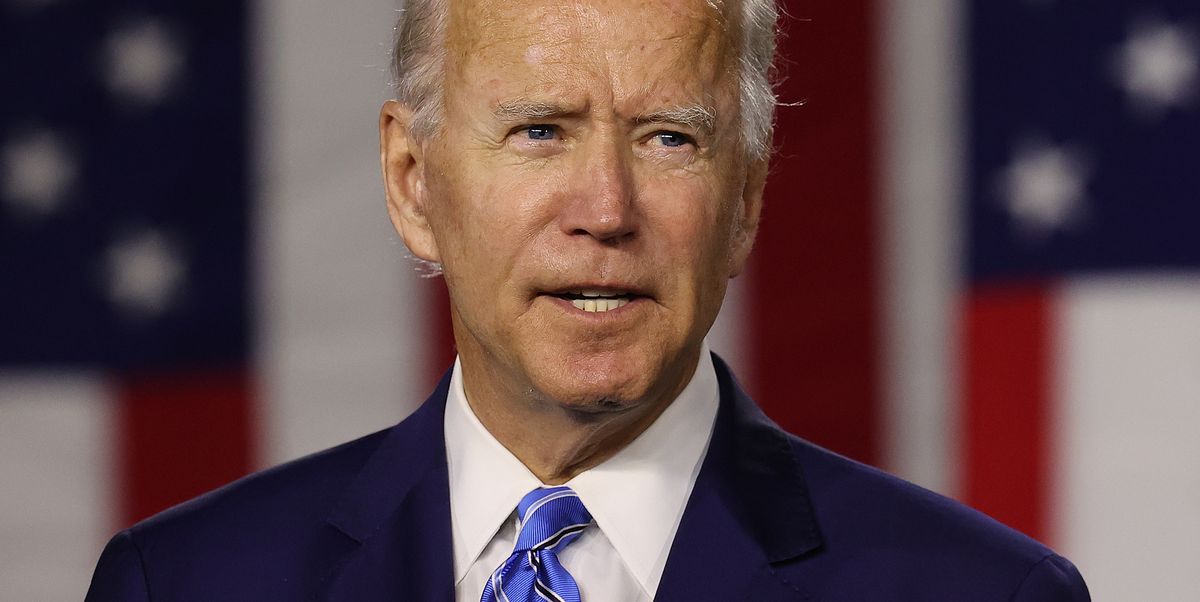

Chip SomodevillaGetty Images

When President-elect Joe Biden steps into the White House this January, he’ll be taking on a nation in crisis. Millions are unemployed, climate change has contributed to this year’s record-breaking natural disasters, and communities are working to tackle the systemic racism permeating every one of our institutions.

As Biden works to revive an economy that’s faltered due to the coronavirus pandemic, he’ll also be faced with another mess: our nation’s student-loan debt. As of this February, Forbes reported there were a total of 45 million borrowers in the United States who collectively owed nearly $1.6 trillion in student-loan debt, making it the second highest consumer debt category. The average amount of student-loan debt is $32,731. The average student loan payment? $393. And, as Biden has noted, a disproportionate number of adults who fall behind on their payments are Black, contributing to and resulting from the country’s persistent racial wealth gap.

But how does he plan to tackle this particular issue? Biden has been transparent about his support for some kind of student-loan debt cancellation and has laid out his plans for higher education reform. Though there’s still the question of how far he’s willing to go and what he can actually get done while in office, as Forbes reports, “It’s unclear whether Biden or Congress will cancel student loans, how much student loan debt would be cancelled and when student loan forgiveness would happen.”

Ahead, more of what we do know about Biden’s plans and how they could affect you.

If you’re a person with student loans to pay off…

…Biden supports forgiving $10,000 of your debt. More specifically, he’s voiced supported for a bill proposed by House Democrats called the Heroes Act, which calls for forgiving $10,000 of student-loan debt as pandemic relief, including private student loan forgiveness for “economically distressed borrowers.” However, passing this type of relief bill could depend on how Congress stands when Biden takes office, more specifically whether Democrats are able to win both runoff elections in Georgia this January and secure a majority in the Senate. Though some in Congress have suggested Biden cancel student-loan debt with an executive order, a process that could result in legal challenges, he has yet to stay whether he would try.

If you don’t have student loan debt yet…

…but are planning to borrow in the future, Biden’s plan could help. According to his proposal, Biden wants to provide people with two free years of community college or job training and make public colleges and universities tuition-free for families with incomes below $125,000. He’s also proposed investing $18 billion into Historically Black Colleges and Universities (HBCUs), Tribal Colleges and Universities (TCUs), and Minority-Serving Institutions (MSIs), “equivalent to up to two years of tuition per low-income and middle class student,” per his website. Biden also wants to double the maximum value of Pell grants.

If you make $25,000 or less a year…

…and Biden was able to put his plan in place, you would no longer owe payments on your undergraduate federal student loans, and you wouldn’t accrue interest on those loans.

If you make more than $25,000 a year…

….Biden wants to change how much you pay per month. According to The Cut, many people with federal student loans are on an income-based repayment plan and must pay 10 to 20 percent of their discretionary income toward their loans per month. (Discretionary income is your income minus taxes and essential spending, like rent and food.) Under Biden’s plan, people who make more than $25,000 a year would only pay five percent of their discretionary income, and after 20 years, the remainder of the loans “for people who have responsibly made payments throughout the program” would be completely forgiven. However, for both of these plans to work, Biden might need congressional approval to change how forgiven loans are taxed.

If you work in public service…

…Biden has proposed creating a program where people earn $10,000 of undergraduate or graduate student debt relief for every year of national or community service they complete for up to five years. If you were to work in a school, government, or other nonprofit setting, you’d be automatically enrolled, and you would also qualify for relief if you have up to five years of prior service. (In his plan, Biden also acknowledges that the current federal Public Service Loan Forgiveness program is “broken” and aims to fix it.)

If you were scammed by a for-profit college…

…you will probably finally receive assistance. According to the New York Times, under the Trump administration, “the government program meant to forgive the federal loans of cheated students has all but stopped functioning,” leaving thousands of relief claims in limbo. Biden, on the other hand, wants to return to the “borrower defense” program and forgive student-loan debt for people were deceived by for-profit colleges or “career profiteers.” He also wants to require for-profit colleges to “prove their value” to the U.S. Department of Education before gaining eligibility for federal aid.

If your student-loan bills are currently paused…

…it’s unclear what’s going to happen next. Throughout much of the pandemic, there’s been a temporary freeze on federal student-loan payments, but it expires at the end of the year, and President Trump has yet to say whether he will extend it. (With the current freeze, federal student-loan payments are temporarily paused and not accruing interest, and there’s been no collection on defaulted debt, according to Forbes.) Though Biden has not said whether he will extend the rule through executive order, he could do so once he takes office and even make the relief retroactive to the first of the year.

If you have private loans…

…you’re in a trickier situation. According to Forbes, most proposals reference cancelling federal student loans, which covers a majority of the national student debt. The outlet reports that while “conceivably, Congress could forgive federal student loans, private student loans or both” in some capacity, private loans are more complicated, and if student loans are cancelled, they will most likely be federal loans.

This content is created and maintained by a third party, and imported onto this page to help users provide their email addresses. You may be able to find more information about this and similar content at piano.io